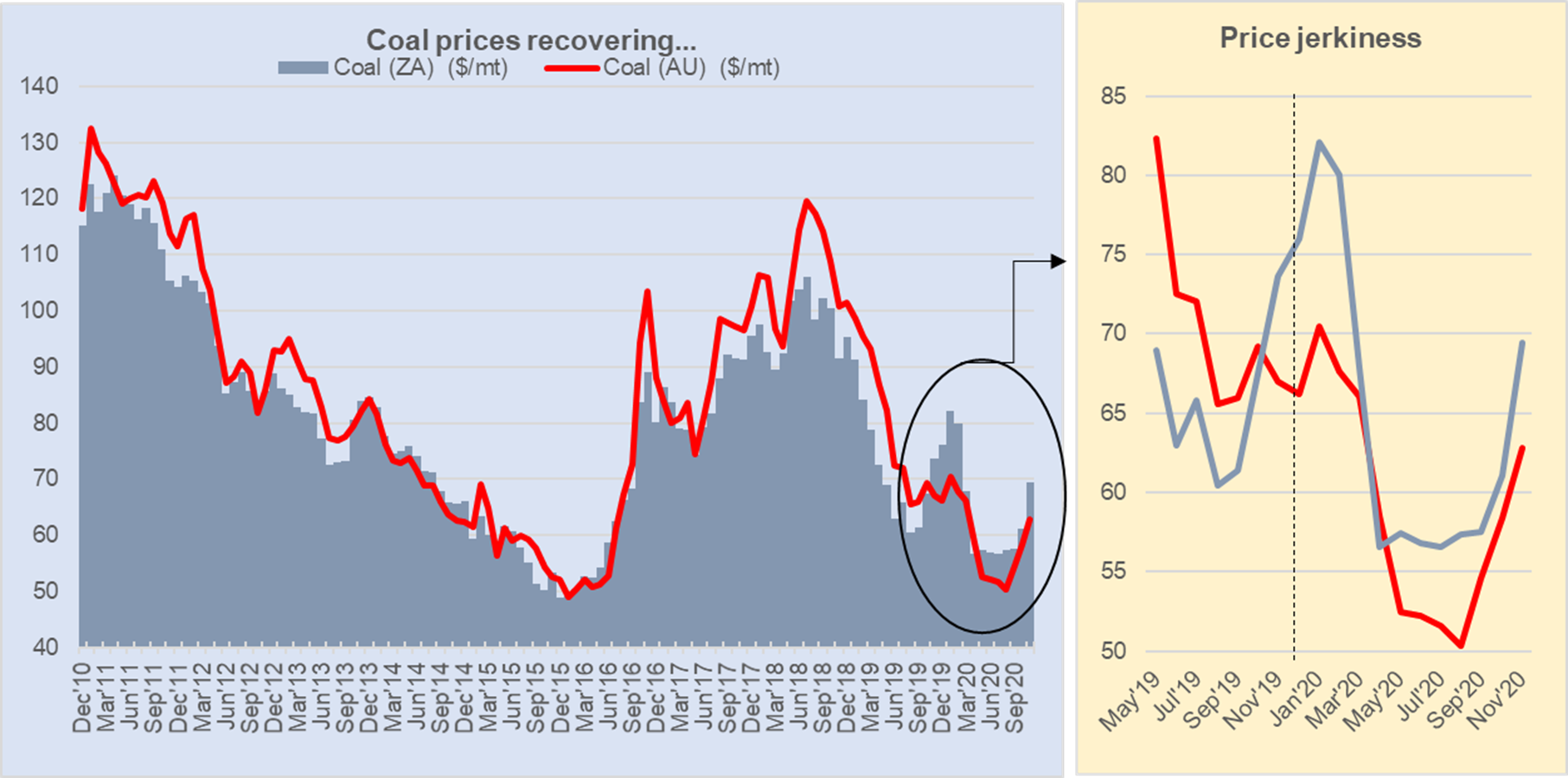

Cold winter in need of heat and post-covid industrial demand from China are breathing life back into coal demand and as a result, sending China and global coal prices hurtling up; a trend that seems to be following the same pattern as it did this time last year. As Jan-19 rolled in, coal prices began to inch up as inventories reduced. However, with Covid-19 hitting the world as it did, prices started falling after the peak in January amid fast shrinking demand. They are climbing up again.

Strong demand is not the only factor though. There are supply restrictions, production cuts as many coal mines are not operating due to environment concerns and bans on imports that are further shaking up the machinery. China has an embargo on imports of coal from Australia which is causing internal scuffles as the power industry in China grapples with the new reality. Local power plants preferred Australian coal for its higher efficiency and were hard-pressed to find adequate alternatives. This has only be exacerbated by a recovery in the economy and industrial stimulus the Chinese economy has received after kicking off its covid habit.

Even as it affects industrial growth, the informal trade ban with Australia has lingered on for months with stranded shipments not able to unload onto Chinese shores. The sanction does not seem to be going anywhere given the political and diplomatic reasons they were imposed in the first place. The country has been replacing Australian coal with imports from other countries such as South Africa and Russia where coal prices have quickly rebounded up. Meanwhile, Australian coal miners are off-loading coal to other regions including many in Asia where stalled demand is coming back up causing Australian thermal prices to also rally.

While the ban on Australian goods is unlikely to be reversed by China, and mounting industrial demand is not about to let up, the demand-supply interplay will continue to affect global coal markets and prices are likely to remain in flux. This will affect coal-using industries including power, cement and steel sectors which will cause their prices to go up, as is already evident.

| Source: Business Recorder |

| Submitted By: BR Research |

| Date: January 12, 2021 |